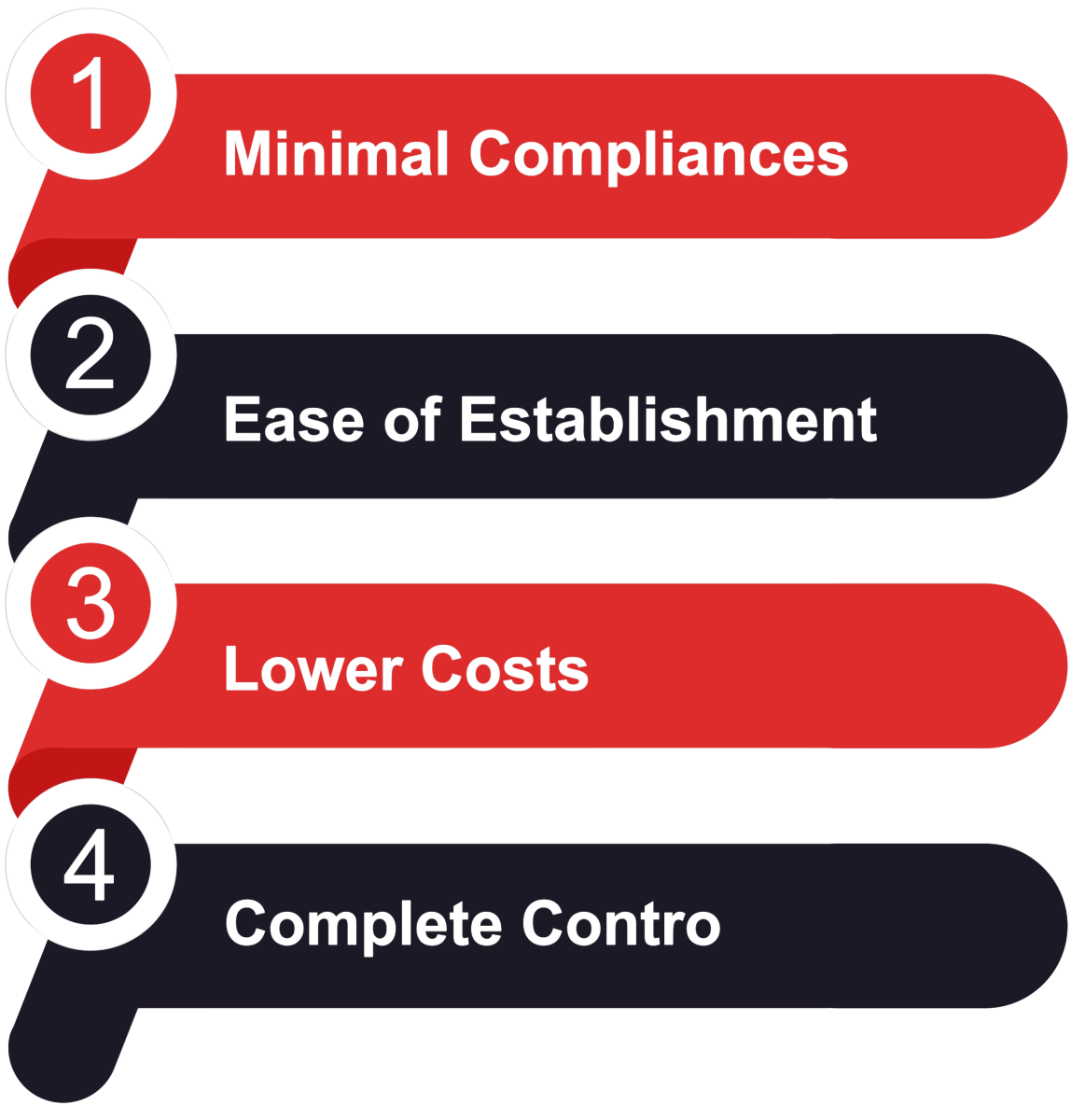

Benefits of Sole Proprietorship Registration

- Minimal Compliances: Sole proprietorships have minimal compliance requirements compared to other business structures, such as One Person Companies (OPCs).

- Ease of Establishment: Since there is no mandatory registration governed by law, setting up a sole proprietorship is straightforward.

- Lower Costs: With fewer compliance requirements, there is no need to hire an auditor, reducing operational costs.

- Complete Control: The proprietor has full control over business decisions without any external interventions.

Registrations Required for Sole Proprietorship

While a sole proprietorship does not require mandatory registration, obtaining certain registrations can enhance the business's credibility and legal standing:

- GST Registration: Mandatory if the business's annual turnover exceeds ₹40 lakhs for goods or ₹20 lakhs for services. It is also required for inter-state supply of goods and services or if the business is involved in e-commerce.

- MSME Registration: Registering under the Micro, Small, and Medium Enterprises (MSME) Act can provide benefits such as easier access to loans and various government schemes.

- Shop and Establishment Act License: Depending on local laws, this license may be required to legally operate the business premises.

Procedure for Sole Proprietorship Registration

- Application for GST Registration: If applicable, apply for GST registration, which typically takes 5-10 working days.

- MSME Registration: File an application to register your firm as a Small and Medium Enterprise under the MSME Act to avail various benefits.

- Shop and Establishment License: Obtain this license from the local municipal corporation based on the number of employees or workers in the firm.

- Bank Account Opening: After completing the above steps, open a current bank account in the name of the proprietorship firm.

Documents Required for Sole Proprietorship Registration

- Personal Documents:

- Copy of Aadhaar Card

- Copy of PAN Card

- Business Address Proof:

- Utility bills (electricity, water, etc.)

- Rent agreement, if applicable

Documents Issued After Registration

Upon successful registration, you will receive:

- GST Registration Certificate (if applicable)

- MSME Certificate

- Shop and Establishment Act License

Fees for Sole Proprietorship Registration

The total cost for registering a sole proprietorship firm in India is approximately ₹8,999, including government and professional fees. This covers mandatory registrations like GST and MSME.

Time Required for Registration

On average, the registration process takes about 7-10 working days, subject to document verification by the concerned authorities.

Frequently Asked Questions (FAQs)

- How do I register my business as a sole proprietorship?

- While no formal registration is required, obtaining GST registration, MSME registration, and a Shop and Establishment License can provide legal recognition and benefits.

- Do I need a GST number as a sole proprietor?

- GST registration is mandatory if your turnover exceeds the specified threshold or if you engage in inter-state supply of goods and services.

- What are the advantages of a sole proprietorship?

- Advantages include minimal compliance requirements, ease of setup, lower costs, and complete control over business decisions.

- How long does it take to register a sole proprietorship firm?

- The process typically takes 7-10 working days, depending on document verification by authorities.

Registering your business as a sole proprietorship provides a straightforward and cost-effective way to commence operations with full control. Consulting with legal professionals or service providers specializing in business registrations can ensure a smooth and compliant registration process.

For more detailed information and assistance with sole proprietorship registration, you can visit Professional Utilities' official website