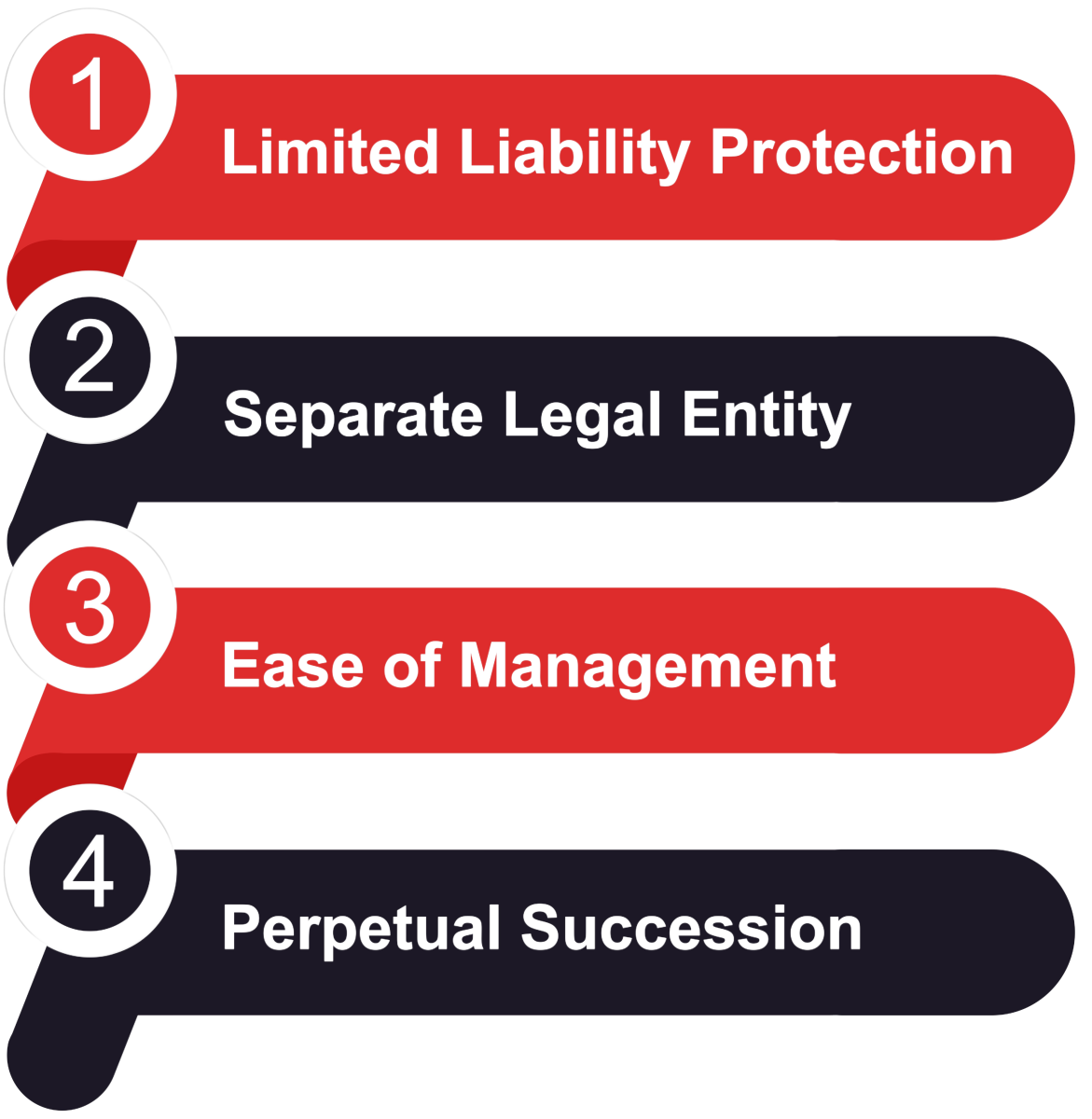

Benefits of One Person Company Registration

- Limited Liability Protection: The owner's personal assets are safeguarded against business liabilities, ensuring that personal wealth is not at risk in case of business debts or losses.

- Separate Legal Entity: An OPC is distinct from its owner, enabling it to own property, incur debts, and enter into contracts in its own name.

- Ease of Management: With a single owner, decision-making is streamlined, and compliance requirements are simplified compared to other corporate structures.

- Perpetual Succession: The company continues to exist beyond the life of its owner, ensuring business continuity.

Eligibility Criteria for OPC Registration

- Natural Person: Only a natural person who is an Indian citizen and resident in India is eligible to incorporate an OPC.

- Nominee Requirement: The sole member must nominate another person as a nominee in case of their death or incapacity. The nominee must also be an Indian citizen and resident.

Procedure for One Person Company Registration

- Obtain Digital Signature Certificate (DSC): The proposed director must acquire a DSC to sign electronic documents.

- Apply for Director Identification Number (DIN): File for a DIN through the Ministry of Corporate Affairs (MCA) portal.

- Name Approval: Submit an application for name reservation through the RUN (Reserve Unique Name) service on the MCA website.

- Prepare Incorporation Documents: Draft the Memorandum of Association (MOA) and Articles of Association (AOA), along with other required documents.

- File Incorporation Forms: Submit the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) form along with the necessary documents to the Registrar of Companies (ROC).

- Obtain Certificate of Incorporation: Upon verification, the ROC issues the Certificate of Incorporation, signifying the legal existence of the OPC.

Documents Required for OPC Registration

- Identity Proof: PAN card and Aadhaar card of the director and nominee.

- Address Proof: Recent utility bills or bank statements of the director and nominee.

- Registered Office Proof: Rent agreement and NOC from the owner, or property ownership documents.

- Photographs: Passport-sized photographs of the director and nominee.

Compliances for One Person Company

- Annual Returns: File annual returns and financial statements with the ROC.

- Income Tax Returns: Submit annual income tax returns.

- Statutory Audit: Conduct an audit of financial statements by a qualified Chartered Accountant.

Frequently Asked Questions (FAQs)

- Can an OPC have more than one director?

- Yes, while an OPC can have only one member, it can appoint up to 15 directors.

- Is there a minimum capital requirement for OPC?

- No, there is no mandatory minimum paid-up capital for an OPC.

- Can an OPC be converted into other business structures?

- Yes, an OPC can be converted into a Private Limited Company or Public Limited Company after meeting certain criteria.

Registering a One Person Company offers individual entrepreneurs the advantages of limited liability and a separate legal entity, facilitating business growth and credibility. It is advisable to consult with legal professionals or service providers specializing in company registrations to ensure a seamless incorporation process.

For more detailed information and assistance with One Person Company registration, you can visit the Ministry of Corporate Affairs' official website